How to use WeChat Pay: A Guide for Foreigners

Using WeChat Pay with International Cards: A Guide for Foreigners

WeChat is the most widely used social app in China, integrating instant messaging, social networking and lifestyle services into one platform. As of September 2023, WeChat had over 1.26 billion monthly active users. In China, WeChat is much more than just chatting and socializing - it can be used for payments, shopping, ride-hailing, food delivery, reading, gaming and more. WeChat has become a super app that almost fulfills all aspects of people's daily lives. It is fair to say that WeChat has been deeply integrated into Chinese people's everyday life.

However, for foreigners visiting China, using WeChat Pay has long been inconvenient, preventing them from enjoying the conveniences of WeChat Pay like locals. The good news is that starting July 20, 2023, WeChat Pay has fully upgraded its services for international bank card users. From July 20, 2023 onwards, overseas users can use WeChat Pay bound to their foreign payment cards for the vast majority of merchants in dining, transportation, hospitality, supermarkets and other sectors across China. At the same time, foreign card users also support various payment methods including QR code scanning/flashing, in-app payment, password-free direct debit, and in-mini programs payment.

Step-by-Step Guide to Adding and Using Foreign Cards on WeChat Pay

- Get ready with your international card and related identity documents.WeChat Pay now supports major international bank card networks including Visa, Mastercard, Diners Club, Discover, and more.

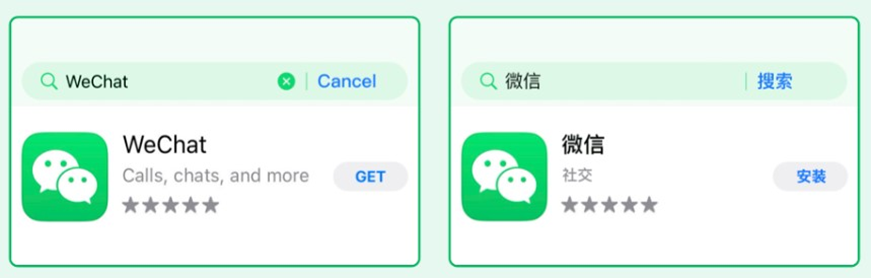

- On your mobile phone, Download or Update your WeChat app to the latest version. Register with your phone number or sign in.

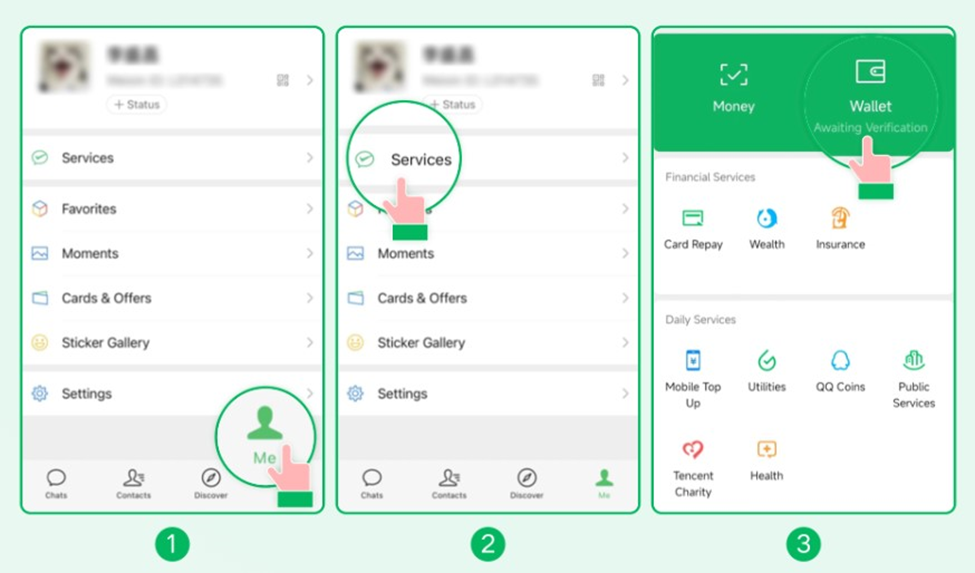

- Where to find Weixin Pay. Tap Me -Services- Wallet

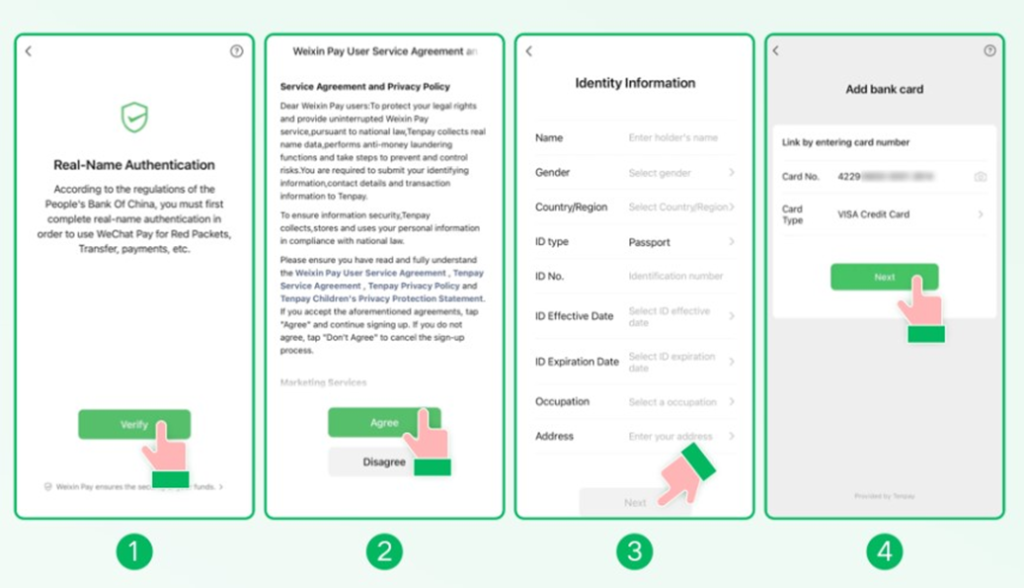

- Fill in your identity information and add a card. In Wallet, tap Add a Card. Read the Weixin Pay User Service Agreement and Privacy Policy and tap Agree. Follow the steps on the screen to fill in your identity information. Tap Next to add your card. Follow the instructions on the screen to complete the process.

Tips: If you use your passport to verify your identity, you will get a notification asking you to upload a copy of your passport.

Frequently Asked Questions

- Q: Does the phone number verified during overseas card binding need to be a Mainland China number?

A: No, it does not. As long as the overseas phone number can receive SMS verification codes, it can be used for verification. - Q: What types of transactions does Weixin Pay currently support for international cards?

A: Currently, international cards support daily consumption transactions in Mainland China. They do not yet support transactions like red packets and money transfers. Please refer to the payment page prompts for details. - Q: What are the limits for international card payment? How is the exchange rate calculated?

A: There are certain limits when using an international card for payment through WeChat Pay. The limit is 6500 RMB per transaction, 50,000 RMB per month, and 65,000 RMB per year. The exchange rate used when you make a payment will be based on the exchange rate set by your card issuing network and bank. - Q: Are there fees for international card payment?

A: There is a fee for using an international card for payment. Transactions below or equal to 200 RMB have no fees. A 3% fee is charged for transactions over 200 RMB. If you initiate a refund, the fees will be returned pro rata based on the refund amount. Please refer to the payment page for the final prompt.

With WeChat Pay strengthening services for foreign users, China has reiterated its commitment to create a more welcoming and convenient environment for international travelers. As the world continues to embrace the digital age, initiatives like this not only simplify financial interactions, but also bridge cultures through technology. Whether casually enjoying a dinner, taking public transport, or shopping to one's heart's content, WeChat Pay's breakthrough stands to reshape international visitors' transaction experiences across China.

Leave a Reply