Wechat Pay Guide

In this guide you will learn:

• What is WeChat Pay?

• How does Wechat Pay Work?

• How to use WeChat Pay

What is WeChat Pay?

WeChat Pay is a mobile payment tool launched by Tencent. It leverages the social attributes of WeChat to provide users with a fast and secure payment experience. It supports online shopping, offline scan code payment, and can also be used for transfers, utility bill payments, mobile phone recharges, and various other scenarios. By binding bank cards or credit cards, users can complete various transactions without touching cash.

How does WeChat Pay work?

The working principle of WeChat Pay is mainly based on the integrated payment function of the WeChat client. It is based on quick payment by binding bank cards, and provides users with a safe, fast and efficient payment service. WeChat Pay has designed two types of QR codes: 收款码 (Shōukǔan mǎ) and 付款码 (Fùkuǎn mǎ). 付款码 (Fùkuǎn mǎ) is used by users when shopping. Merchants complete the payment by letting customers scan the 付款码 (Fùkuǎn mǎ). 收款码 (Shōukǔan mǎ) is used by users when they need to receive payments. For example, if a courier damages a user's item and needs to compensate, the user can use the 收款码 (Shōukǔan mǎ) to let the other party complete the compensation through WeChat transfer.

How to Use WeChat Pay

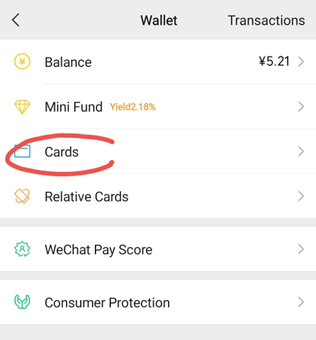

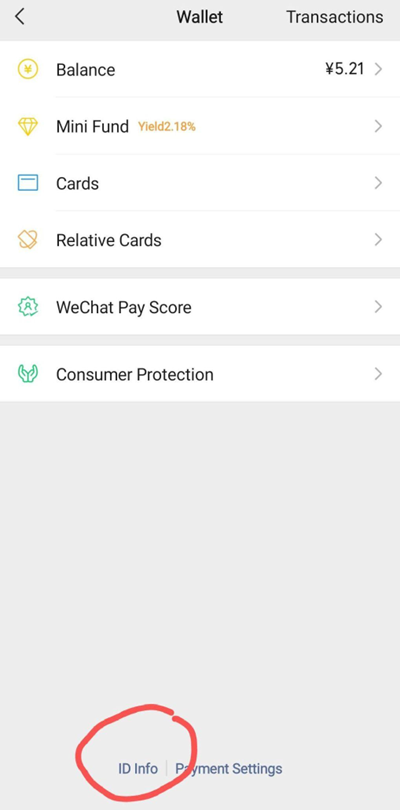

- Activate WeChat Pay: To use WeChat Pay, the first step is to activate the payment service in your WeChat Wallet. The specific steps are as follows: First, open the WeChat App, click on "Me" → "Services" → "Wallet" → "Cards" → "Add a Card", then follow the prompts to fill in the bank card information and complete real-name authentication to successfully create a WeChat Pay wallet. After real-name authentication, you can make payments and receive money.

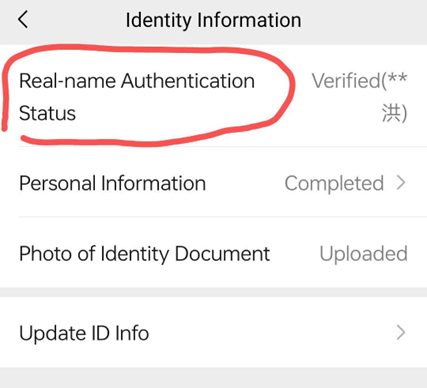

Please note that: The name of the account holder bound to the bank card must be the same as the name of the WeChat Pay real-name authentication. In addition, minors who are over 16 years old can use their ID cards to apply for bank cards with their guardians for real-name verification. However, for those under 16 years old, there is no way to perform real-name authentication.

Enter WeChat, Click on "Me" → "Services" → "Wallet" → "ID info" → "Real-name authentication", and then follow the steps.

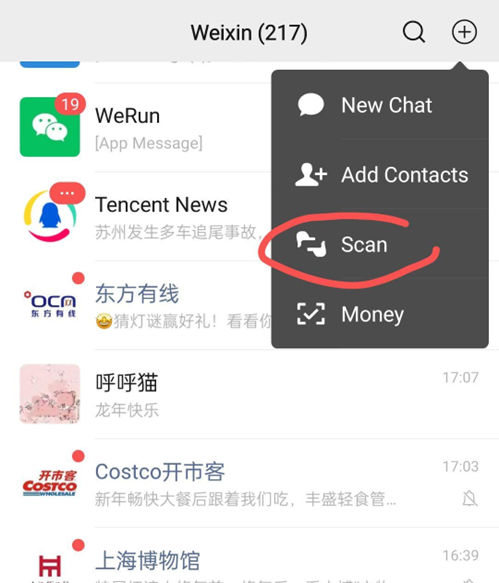

- Make payments with WeChat Pay. At offline stores or online stores that accept WeChat Pay, Click the "+" button in the upper right corner to open the "Scan" function, scan the merchant's payment QR code,then enter the payment amount, input your payment password to complete the payment.

Alternatively, the merchant can scan your payment code to complete the payment. Click the "+" button in the upper right corner then click the “Money” button to show your payment code. (WeChat has clear regulations that prohibit the public sharing of payment code images. Therefore, please operate on your own mobile phone to view.)

- Receive money through WeChat Pay. You can use WeChat payment function to generate a QR code for customers to scan. Click the "+" button in the upper right corner → click the “Money” button → click the “Receive Money” button to show your QR code. (WeChat has clear regulations that prohibit the public sharing of payment code images. Therefore, please operate on your own mobile phone to view.)

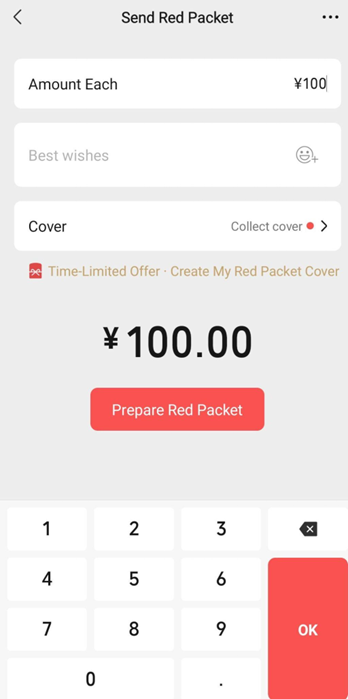

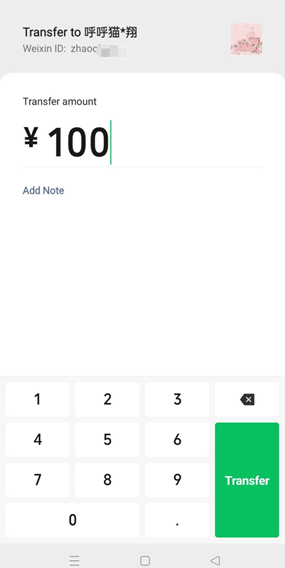

And you can receive money through WeChat transfers or red envelopes. When someone transfers money to you or sends you a red envelope on WeChat, you will receive a notification, and can check the payment details directly in your Wallet.

- In addition to payment and money receiving functions, WeChat Pay also supports bill enquiries, utility payments, public transport payments and other functions. Users can check their transaction history and manage funds anytime, and participate in various promotional activities for more benefits. Also, WeChat Pay supports cross-border payment, allowing users to make convenient payments overseas as well.

As a pioneer in smart mobile payment, WeChat Pay has revolutionized the way people live in China. Connecting with the finances of hundreds of millions of users, it has become an indispensable part of everyday life, offering unparalleled convenience.

Leave a Reply